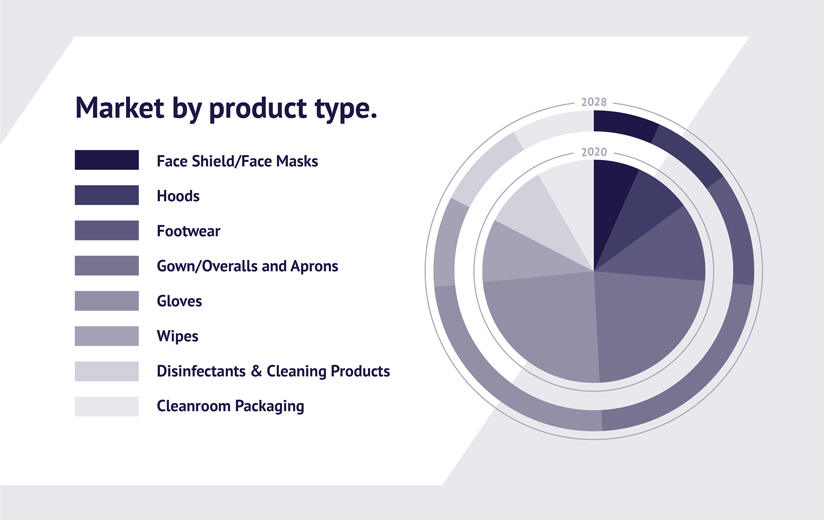

Due to the COVID-19 pandemic, cleanliness has been critical. From the safety of staff, customers and business environments, to the supply of critical products and equipment, this has led to a growth in the cleanroom consumables and technology markets. According to Inkwood Research, the global cleanroom consumables market will reach $20.87 billion by 2028, growing at a CAGR of 9.17% during the forecast period 2021 to 2028. And according to Business Wire, the cleanroom technology market is expected to grow at a CAGR of 10.1% between 2021 and 2026, aided by sustainable innovations. With high standards to be met and continued reliance on the cleanroom industry expected, there will also be a range of emerging challenges to overcome in 2022.

- Continuing production during COVID-19

With the outbreak of COVID-19, it has become imperative for industries to maintain the highest level of hygiene and take up clean manufacturing measures. This could be from ensuring products bought are certified and meet regulatory requirements to choosing what will be most effective for your business.

Based on currently available information, there is a high risk of exposure to COVID-19 in India.

- Keeping abreast of legislation and standards

Ensuring compliance is met within the cleanroom industry is an ongoing challenge.

Whilst there’s no stringent restrictions in place at the moment in India with disinfectants, the global trend with EU BPR and UK BPR, alongside the USA EPA registration requirements could be indicative of the way things are going, and those within the industry need to be aware of latest legislations and ensure cleanrooms are compliant.

- Dealing with raw material price increases

According to Inkwood Research, prices for raw materials used to manufacture cleanroom consumables have increased over the past few years, alongside transportation, energy and other services. A factor that could have contributed to the price increase is the rise in online shopping. According to Statista, as of February 2021, 71% of people are buying more online than before due to the COVID-19 pandemic. This meant more home deliveries packaged in all polymer-based products – the same material used in bulk to produce essential PPE – putting strain on raw materials.

European Plastics Converters (EuPC), which represents European plastics converters, said it was something the industry had never faced before, and IVK Europe, which represents plastic and rubber sheet manufacturers, said there is no improvement of this situation in sight.

(Source)

- Global packaging shortage

Packaging shortages have also become an issue due to a number of factors. A BBC article covering the issue talked about how the rise in online ordering has resulted in companies like newly launched craft brewery, Jawbone Brewing, being unable to get any boxes. This led to a three-week delay of online deliveries and a plea to local customers on social media to bring their own boxes. The article further explained that multinational packaging firm, DS Smith, said the problem lies partly in the recycling chain, as most deliveries were made in bulk to high street shops and restaurants, so packaging found its way quickly back into the system via recycling firms pre-pandemic.

Another factor, according to a Bloomberg article, which could threaten operations is the power crisis in India due to reserves of coal. The government warned that the country could face issues for up to six months, with independent downstream industries such as plastics, fibers and synthetic rubber potentially being affected, and could have a ripple effect on packaging materials to vehicle tyres.

- Maintaining quality amidst supply chain pressure

Supply chains have also felt the pressure due to lack of drivers, containers, as well as factory standstills and blocked ports – all contributing to the global supply chain crisis. An insightful article released in October from The Week explained that “There was a consensus earlier in the pandemic that factories and shipping companies would catch up with demand within a matter of months and clear the backlog. But that didn’t happen before the peak pre-Christmas shipping season began. Moody’s Analytics warns that supply-chain disruptions “will get worse before they get better”. More optimistically, the investment bank Jefferies predicted this week that October would turn out to be the worst month, and that we are already “past the peak pinch” on cargo ship delays, port bottlenecks and labour shortages. But even so, most experts predict that it will take at least six months and possibly more than a year for the situation to stabilise.”

As businesses catch up on the backlog of orders, COVID-19 restrictions ease, and more vaccines are rolled out, we’re hoping it’ll reduce pandemic waves and subsequent lockdowns around the world impacting businesses.

There’s also value in going by the saying ‘it’s better to have it and not need it, than to need it and not have it’. By businesses looking into holding more stocks, it protects against logistical disruption such as the one we’ve been going through.

Despite the struggles we’ve seen across the industry, here at AGMA, we’ve aimed to maintain a continuous supply of critical products to our cleanroom customers.

Explore the AGMA range, download our Healthcare Product Guide.